In this blog we explain what are the different types of MVNO, and compare them based on operational models, profit margins, CAPEX, OPEX, and more.

Table of contents

The Mobile Virtual Network Operator (MVNO) model has matured into a critical force that’s shaping telecom markets worldwide.

By leasing capacity from Mobile Network Operators (MNOs), MVNOs can launch mobile services without building expensive radio networks.

Some MVNOs are simple branded resellers. Others run their own core network, issue SIM/eSIM cards, and manage roaming agreements like a proper carrier.

The difference between these models is night and day when it comes to cost, control, and scalability.

So, to summarize: your MVNO type determines your margins, operational complexity, and long-term competitiveness.

In this guide, we’ll break down the five main MVNO types: Skinny, Thin, Light, Thick, and Full MVNO.

We’ll also look at their technical setup, commercial models, pros and cons, and some real-world examples. Whether you’re considering entering the MVNO market or evaluating a pivot, understanding these MVNO types will help you prepare the best strategy for success.

What Are The Different Types of MVNO?

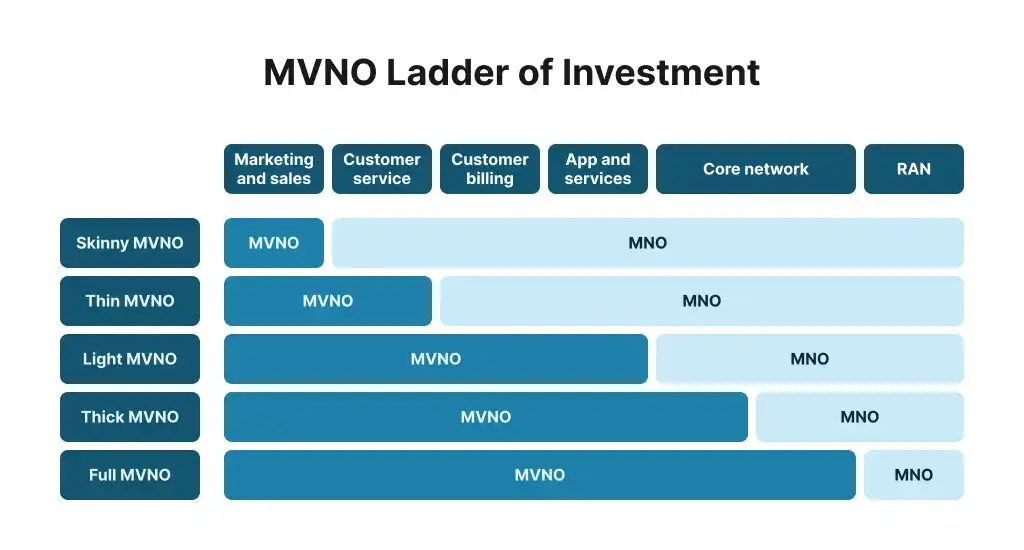

Regulators and analysts often describe MVNOs along a “ladder of investment”. The higher you climb, the more control (and responsibility) you assume.

There are five main types of MVNOs:

- Skinny MVNO (Branded Reseller)

- Light MVNO

- Thin MVNO (Service Provider)

- Thick MVNO

- Full MVNO (Core Network Operator)

Author’s note

You might come across other resources that group MVNOs into just three categories. For this blog, we’ve chosen a broader five-type model to give you the most complete picture of how virtual operators differ in structure and control.

There are also MVNE and MVNA, which help many MVNOs to launch without massive upfront investment.

In the table below, you’ll find the key features of MVNO types at a glance:

| MVNO Type | Setup | CAPEX/OPEX | Margins | Best for |

|---|---|---|---|---|

| Skinny MVNO | Brand & distribution only | Very low | ~10-20% | Retail brands with mobile as an add-on product |

| Thin MVNO | Basic CRM and customer support | Low to moderate | ~15-25% | Brands that want more customer ownership without heavy telco investment |

| Light MVNO | Owns OSS/BSS | Moderate | ~20-35% | Brands building distincs mobile identity with custom tariffs and CX. |

| Thick MVNO | Partial core ownership (HLR/HSS, HHSN/PGW, policy control). Still uses host MNO for RAN | High | ~35-50% | Enterprises and IoT MVNOs in need of more control over services, QoS, and roaming. |

| Full MVNO | Full core network (HLR/HSS, MSC, billing, SIM provisioning, interconnect). Owns SIMs, numbering, and roaming agreements. | Very high | ~45-70% | Telcos, ISPs, large enterprises in need of maximum independence and long-term scalability. |

Skinny MVNO Type (Branded Reseller)

Skinny MVNO serves as the entry point on the MVNO ladder of investment. They focus almost entirely on brand and distribution.

Technical setup

- No core network, OSS/BSS, or SIM/eSIM management of their own.

- Host MNO handles provisioning, billing, customer care, and network functions.

Business Perspective

Because Skinny MVNOs operate on a retail-minus wholesale model, their margins are modest (around 10-20%).

CAPEX and OPEX are minimal, making it the fastest and cheapest way to get to market, but scalability is limited.

This setup works best for companies that want to extend their existing brand reach, like retailers. Think of cases where mobile connectivity is just another product on the shelf or an add-on to an existing customer base.

The trade-off here is control. Skinny MVNOs have virtually none.

Pricing, bundles, and even service quality are dictated by the host MNO. That means they’re highly dependent on the MNO’s roadmap and can’t really differentiate beyond branding.

Monetizing 5G: Unlocking Its Full Potential

Examples

- Walmart Family Mobile, which originally ran on T-Mobile’s network in the US.

- 7-Eleven SpeakOut Wireless in Canada, where mobile connectivity is simply another convenient product sold under a retail brand.

- Aldi Talk (Hofer Telekom) is a nice example in Central Europe, similar to previous two.

👉 For more MVNO examples, check out: Best MVNO Carriers & Mobile Plans List by Country

Thin MVNO Type

Thin MVNOs are a step above being a simple branded reseller, because they start to take on a few operational responsibilities themselves.

However, the host MNO (or sometimes an MVNE/MVNA partner) still carries most of the technical and network workload.

Technical setup

- No ownership of the core network or major infrastructure.

- May manage basic CRM and customer service internally.

- Still rely on the host MNO or an enabler (MVNE) for provisioning, rating, billing, and SIM/eSIM management.

Business Perspective

Commercially, Thin MVNOs typically operate on a per-unit wholesale model (charged per minute, SMS, or GB).

Margins are slightly better than a Skinny MVNO (around 15-25%) but they’re still constrained by MNO’s wholesale product catalog.

CAPEX and OPEX are low to moderate, depending on how much customer support and CRM is running in-house.

This setup is a best fit for brands that want to own a part of the customer relationship without diving too deep into technical and network ops. It allows for a bit more flexibility in marketing and service differentiation, but tariff innovation remains limited.

The trade-off here is heavy dependence on quality and features, because Thin MVNOs don’t have the autonomy to build custom bundles or control QoS policies in a meaningful way.

Examples

- Consumer Cellular (US) is a MVNO using newly activated AT&T network.

- Tello (US) is another US example of a Thin MVNO on T-Mobile’s host network, offers customizable plans.

Light MVNO Type

Light MVNOs are the true middle tier of MVNO types. They take full ownership of the customer relationship and manage more of the business operations. But, they still don’t run their own core network.

Technical setup

- Operates its own OSS/BSS platforms: billing, charging, CRM, number portability, and customer care.

- Issues SIMs or eSIMs under their own brand.

- Relies on the host MNO for the radio access network (RAN) and core network functions.

Business Perspective

Because Light MVNOs have their own BSS, they can design and launch their own tariffs, bundles, and promotions independently of the host. This brings a meaningful degree of flexibility compared to Skinny and Thin MVNO types.

Commercially, they’re often on per-unit or tiered usage agreements, with margins in the 20-35% range.

CAPEX and OPEX are higher because they need to invest in billing, CRM, and regulatory systems, but this also gives them more long-term scalability.

Light MVNOs are a good fit for companies that want to be more than just resellers and want to build a recognizable mobile brand with differentiated pricing, customer care portals, and value-added services.

The trade-off here is that they are still tied to their host MNO when it comes to network quality, new technologies, and QoS policies. They can compete with pricing, branding and CX, but not with raw network performance.

Examples

- Mint Mobile (US) is a MVNO that runs on T-Mobile. Their brand controls pricing, CX, and distribution. It’s also owned by T-Mobile since 2023 but still operates as a seperate MVNO brand.

- LycaMobile (multi-country) is a large international MVNO operating across multiple hosts. They manage customer livecycle and marketing but also operate as MVNA in a few countries.

- Lobster (Spain) is an English language MVNO on Movistar’s network. Operates as an independent brand with their own BSS.

Thick MVNO Type

Thick MVNOs are a transitional model between Light and Full MVNOs. They begin to own some elements of the core network infrastructure, which gives them more independence and the ability to control certain technical and commercial aspects of their service.

Technical setup

- May operate and manage their own HLR/HSS, GGSN/PGW, or policy control nodes.

- Can handle SIM/eSIM provisioning and sometimes interconnect functions directly.

- Still relie on the host MNO for radio access network (RAN) and parts of core network.

Business Perspective

Because thick MVNOs have partial ownership of the core, they can start to differentiate with features like custom roaming agreements, QoS management, or zero-rating specific services.

This added control usually shifts their wholesale model to capacity-based agreements, where the MVNO buys a chunk of network capacity rather than paying strictly per unit.

Margins are typically in the 35-50% range. CAPEX and OPEX are considerably higher since they must invest in the core infrastructure and the staff to run it, but they gain more leverage and negotiating power with host MNOs.

Thick MVNOs are a good fit for companies that want to move toward long-term independence but aren’t ready to build a complete core network just yet. It’s also attractive for enterprise or IoT-focused MVNOs that need tighter control over connectivity and service quality.

The trade-off is complexity. Running parts of a core network requires telecom expertise, regulatory compliance and higher costs.

But it also opens the door to more sophisticated service offerings and the possibility of evolving into a Full MVNO later down the line.

Examples

- Sky Mobile (UK) also wears the title of a “deep MVNO”. It recently extended its deal with O2 (Telefónica UK) and is positioned publicly as a heavily integrated MVNO.

- Charter Spectrum Mobile (US) is a MVNO on the Verizon network that also builds CBRS small-cell 5G for offload. A hybrid approach that’s typical for thicker control.

- Comcast Xfinity Mobile (US) is also a MVNO on Verizon with heavy Wi-Fi integration. Hybrid MVNO architecture discussions are public in the cable ecosystem.

Note: In the US, “cable MVNOs” like Charter and Comcast increasingly control policy/routing/Wi-Fi offload and sometimes selective mobile core functions. This maps well to “thick” characteristics even if the exact core split isn’t fully public.

Full MVNO Type

Full MVNOs are the most advanced MVNO type. They operate almost like a traditional mobile network operator, with full independence over core systems and customer management.

The only thing they don’t own, is the radio spectrum and the towers themselves.

Technical setup

- Runs its own core network: HLR/HSS, MSC, GMSC, billing and charging systems, SIM/eSIM provisioning, and interconnect gateways.

- Issues its own SIMs and eSIMs and controls its own number ranges.

- Can negotiate roaming and interconnect agreements directly, without going through the host MNO.

Business Perspective

Because Full MVNOs own nearly the whole value chain (minus the RAN – radio access network), they have the maximum flexibility to design products, bundles, and value-added services.

They’re not locked into the host MNO’s roadmap and can innovate faster with features like eSIM, VoLTE, VoWiFi, IoT integrations, or custom roaming packages.

Commercially, Full MVNOs also work on capacity-based wholesale agreements or other similar models.

Margins are the strongest across MVNO types, often in the 45-70% range.

But so are the costs: CAPEX and OPEX are high because building and operating a core network, plus meeting regulatory requirements, is no small feat.

This setup is best suited for large enterprises, ISPs, and established telcos who want full strategic control, strong margins, and the ability to differentiate on both pricing and services.

Full MVNOs can sometimes even act as MVNEs, enabling other MVNOs on their infrastructure.

The trade-off here is obvious: high investment and complexity.

Running a full network core demands deep telecom expertise and long-term commitment. But the reward is a MVNO business that’s scalable, future-proof, and competitive in advanced services.

Examples

- Virgin Mobile UK, one of the first and best-known Full MVNOs in Europe.

- PosteMobile in Italy, which operates independently with its own numbering resources.

- Boost Mobile (under DISH) is also evolving toward a Full MVNO.

Which MVNO Type is “Best”?

There is no single “best” MVNO type, because the right choice boils down to your strategy, budget, and long-term goals.

If by “best” we mean the most control and independence, then a Thick or a Full MVNO would be at the top of the list.

However, control always comes at a cost, both in terms of investment and operational complexity.

On the other hand, the “best” option for businesses seeking faster market entry, lower upfront costs, and reduced risk would be a Skinny MVNO (Branded Reseller).

The best MVNO type is the one that balances control, cost, time to market, and profitability.

And most importantly, it’s the one that aligns with your business model and growth strategy.

MVNO Billing Platform & BSS

Whenever you’re starting your business as an MVNO, you’ll need to cover some of the business operations that come along.

A strong BSS can provide a strong foundation for you customer facing operations.

You shouldn’t settle for overpriced legacy software that doesn’t give you flexibility, and assurance.

That’s where Tridens Monetization for Communications comes into play. It provides a total support for MVNOs of all types to monetize their services effectively, with absolute precision, and in real-time.

With white-label self-service portals your subscribers can seamlessly upgrade their plans, buy add-ons, and you can offer them loyalty rewards or a wide variety of physical products through our ecommerce integration.

We also provide an integrated CRM and service desk, and AI features for decreasing churn rate, increasing sales, and hyperpersonalized messaging and onboarding.

For more information on how we help MVNOs scale, schedule a demo, reach out to our team, or explore other resources dedicated to MVNOs.

Ready to get started?

Learn how your business can thrive with Tridens Monetization for Communications.

Schedule a Demo